Help & support

Use your income and expenses to estimate how much you may be able to borrow for a home loan.

Estimate the other costs of buying a property, including government costs, stamp duty, and fees.

You could potentially save by refinancing your current home loan with us.

Want to know more about a property or an area you’re considering buying or selling in? Your complimentary Property Report is customised to your needs, with the latest information on new listings, auctions and recent sales.

Find your perfect property sooner with market estimates and affordability snapshots.

Compare home loan options and adjust variables like interest rates and loan term.

Work out your budget based on household and lifestyle expenses, to get an idea of how much you may be able to afford in repayments.

Get access to all the property tools and guidance you need in one place in Home Hub within the CommBank app.

Expert guidance, handy tips and useful information – because everyone’s home buying needs are different.

A step-by-step guide to help you refinance, whether it’s for an existing CommBank home loan or to switch from another financial institution.

A comprehensive guide to help you understand the process of building a new home, so you can be in control.

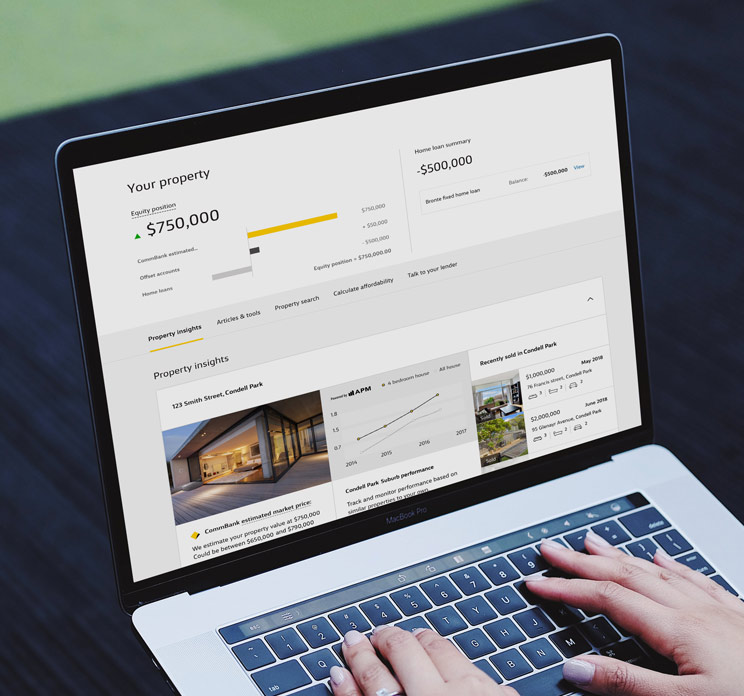

CommBank My Property redefines how you view, track and manage your home loan online to help you achieve your property goals.

Get instant help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

¹ Contracts are reviewed within six business hours 95% of the time (October 2023). To ensure contracts are reviewed within six business hours, customers must upload the entire contract within the Home-in app.

² Home-in has one of the highest on-time settlement rates in the industry with 95% of Home-in customers settling on time in 2023.

Home-in is a brand of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 trading as Home-in Digital. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia. For information about privacy, visit our privacy policy.

©2023 Commonwealth Bank of Australia ABN 48 123 123 124 AFSL and Australian credit license 23

Applications for finance are subject to the Bank's normal credit approval. Full terms and conditions will be included in the Bank's loan offer. Fees and charges are payable.

Our calculators and tools provide estimates for your general information only and are based on the accuracy of information input. The estimates are not a quote or a loan offer.

To be eligible for Wealth Package, you must have a current eligible home loan or line of credit with an initial package lending balance of at least $150,000 when you apply for Wealth Package. The package can be established in the name of one or two individual’s name/s, or in the name of a corporate entity. It cannot be established in the name of a business or family investment trust. Trust loans can however be linked to the trustee package (personal or company package) where the trustee is an applicant (i.e. the borrower) on the loan. For example, a loan held in the name of “John Smith ITF The Smith Family Trust” can have a package established in the name of John Smith as the trustee.

Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc.

*CommBank Exclusive Offer: You’re eligible for the offer if you 1) Settle on a property with a CommBank home loan, and 2) Use the in-app legal services provided through Home-in. To secure the offer you will need to engage the services of Home-in’s partner law firm via the Home-in app. You can find out more about this offer and how to lock it in when you log into the App. Conditions apply. Home-in reserve the right to terminate the offer at any time

“Home-in” is a trademark of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 trading as “Home-in Digital”. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia.